CHARACTERISTICS OF THE GREEK-OWNED FLEET

The largest merchant fleet…

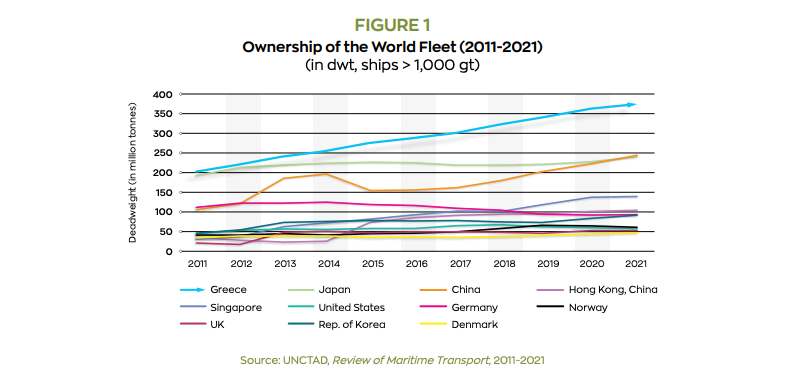

Greece remains the top shipowning nation in the world, as Greek shipowners with 5,514 ships currently control approximately 21% of the global fleet, in terms of capacity (dwt)1. The total capacity of the Greek-owned fleet has increased by 45.8% compared to 2014, while even during the COVID-19 pandemic, i.e., since 2019, capacity rose by 7.4%2.

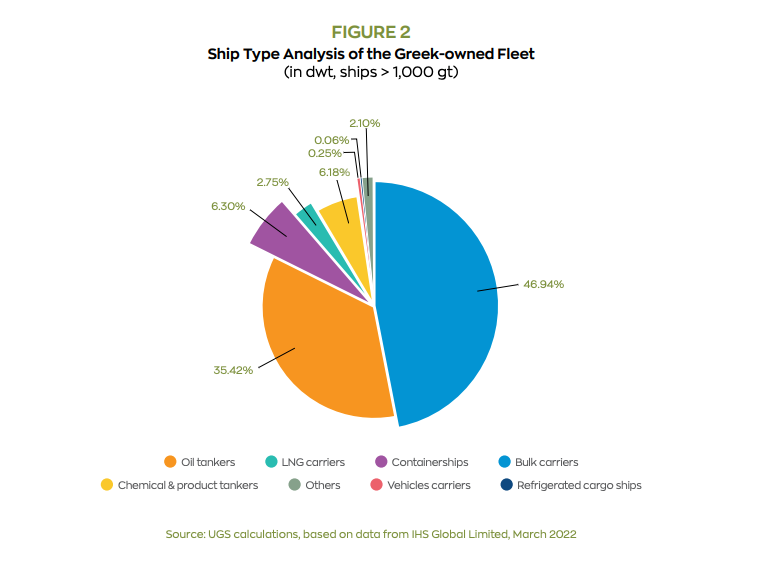

Greek shipowners control:

• 31.78% of the world oil tanker fleet

• 25.01% of the world bulk carriers

• 22.35% of the world Liquefied Natural Gas (LNG) carriers • 15.60% of the world chemical & product tankers

• 13.85% of the world Liquified Petroleum Gas (LPG) carriers

• 9.33% of the world containerships

…operating across the globe.

The Greek-owned merchant fleet transports cargoes between third countries with more than 98% of its fleet capacity, thus being the world’s largest cross trader. Greek shipping is predominantly engaged in bulk/tramp shipping (Figure 2), which is a truly entrepreneurial sector that maintains characteristics of perfect competition: a very large number of private, mainly Small and Medium-sized Enterprises (SMEs), compete globally for business on a daily basis, with flexible, lean and efficient administration and asset management, abundant and transparent access to information, and low entry and exit costs. Shipowners/operators in the bulk/tramp sector are price takers, transporting cargoes on an ad hoc basis. Most vessels in the bulk/tramp trades operate under time charter contracts. The timecharterer assumes the commercial operation of the vessel and determines the cargo type and quantities to be transported, as well as the vessel’s itinerary, routeing and speed.

Greek shipping is the backbone of European shipping…

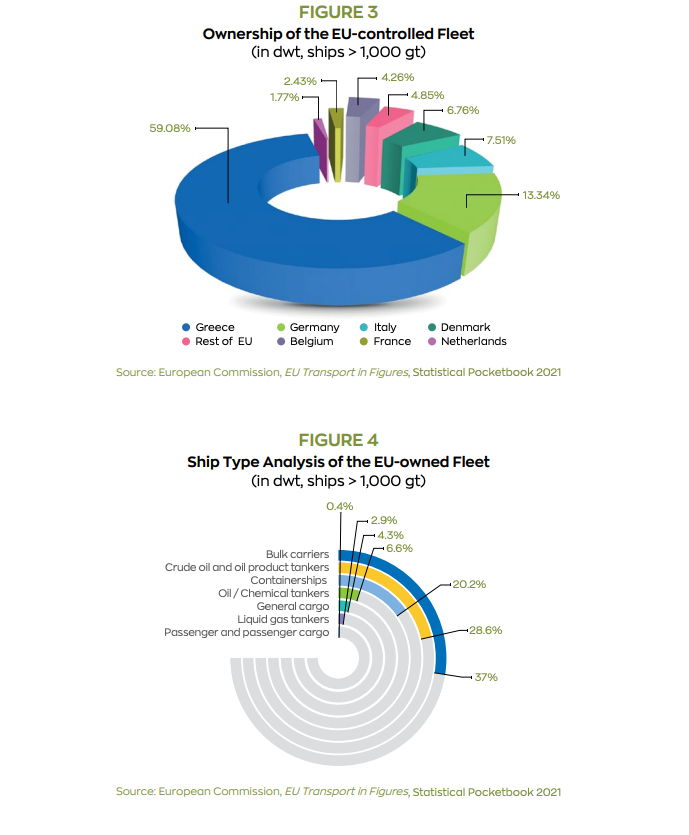

The Greek-owned fleet represents 59% of the European Union (EU)-controlled fleet (Figure 3), with more than 75% of the EU-controlled fleet being active in the bulk/tramp sector (Figure 4). One third of the Greek-controlled fleet flies an EU Member State flag.

…consisting of modern, environmentally friendly and safe vessels.

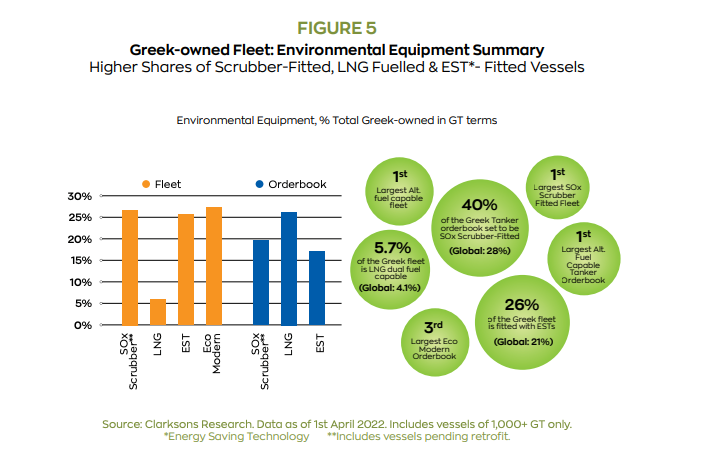

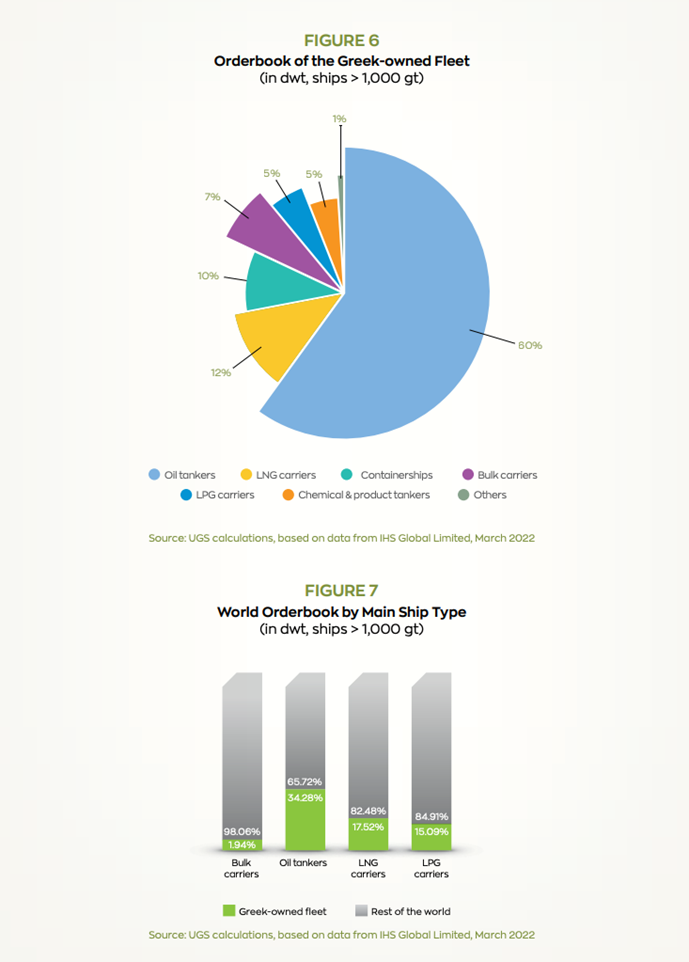

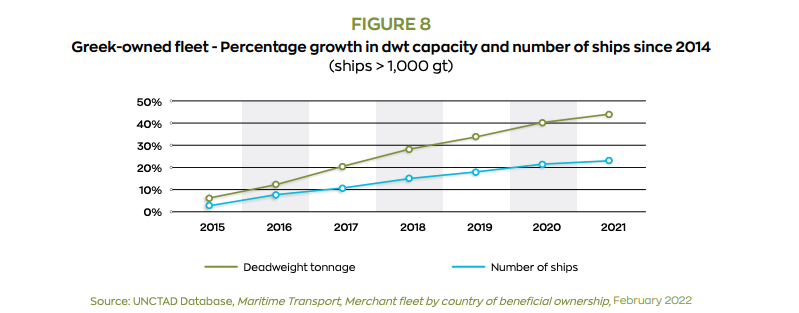

Greek shipowners are constantly investing in new, energy efficient ships and in environmentally friendly equipment (Figure 5), with the average age of the Greek-owned fleet (9.99 years), being lower than the global average (10.28 years). Newbuilding orders from Greek shipowners amount to 173 ships (from 104 ships the year before), corresponding to 17.3 million dwt3 (Figure 6). More than one third of the oil tankers and almost one out of six LNG carriers currently being built in the world will be delivered to Greek shipowners (Figure 7). In addition, more than one quarter (27.6%) of the Greek-owned tonnage (in terms of dwt) falls within the scope of the global standard Energy Efficiency Design Index (EEDI)4, a technical measure of the United Nations (UN) International Maritime Organization (IMO) which ensures an improved energy efficiency for ships.

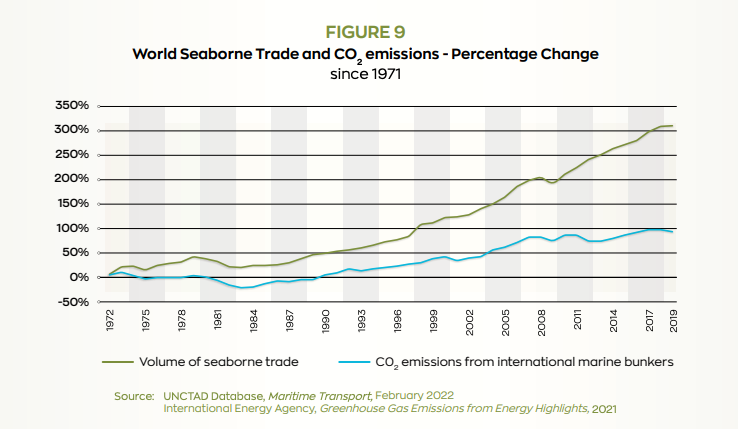

Greek shipowners have steadily been investing in larger vessels, which also exhibit greater efficiency and environmental gains due to the economies of scale they provide. Since 2014, the growth of the deadweight capacity of the Greek-owned fleet has been much higher than the growth of the number of ships (Figure 8).

While in 2014 the average capacity of a Greekowned ship was 71,308 dwt, today the average capacity of Greek ships is estimated at 86,247 dwt, a figure almost double that of the world fleet (45,020 dwt)5.

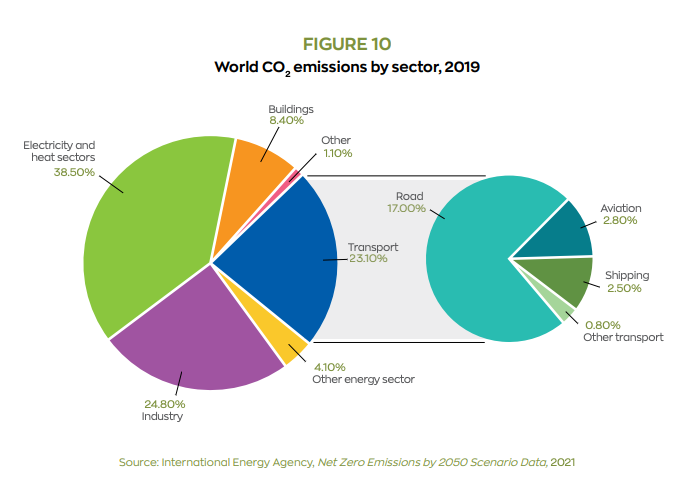

Ιt is important to note that shipping is the most efficient mode of cargo transport. This can be demonstrated also by the fact that, during the past 50 years (Figure 9), world seaborne trade has quadrupled in terms of volume, while CO2 emissions from shipping have just almost doubled.

Compared with other sectors, CO2 emissions from shipping remain at a relatively low level – at 2.5% of total world emissions (Figure 10).

The Greek-owned merchant fleet is the largest in the world and the EU. Greek shipowners have been constantly investing in new, larger and more energy efficient and environmentally friendly vessels.

The situation is similar regarding not only CO2 but also total Greenhouse Gas (GHG) emissions. Indicative data shows that GHG emissions from international maritime transport in the EU have remained at almost the same level as a percentage of total emissions from transport during the last 30 years6.

Ranking 8th in terms of dwt, Greece is one of the main shipping registries in the world and one of the top ones from traditional maritime nations. With 647 ships (above 1,000 gt) registered with the Greek flag amounting to 61.8 million dwt7 , the Greek shipping registry holds the 2nd position in the EU. Greece remains on the IMO’s “List of confirmed Standards of Training, Certification and Watchkeeping for Seafarers (STCW) Parties” and on the White Lists of the Paris and the Tokyo Memorandum of Understanding (MoU). Greece is also included in the Flag Administrations List of the U.S. Coast Guard (USCG) QUALSHIP 21 Program, while it is placed among the bestperforming Flag States with positive indicators across all categories (e.g. ratification of IMO Conventions, Port State Control procedures etc.) in the Flag State Performance Table published by the International Chamber of Shipping (ICS)8.

1 UGS calculations, based on data from IHS Global Limited, March 2022

2 United Nations Conference on Trade and Development, Review of Maritime Transport, 2011-2021

3 UGS calculations, based on data from IHS Global Limited, March 2022

4 MARPOL, Annex VI, Regulation 21

5 UGS calculations, based on data from IHS Global Limited, March 2022

6 European Commission, EU Transport in Figures, Statistical Pocketbook 2021

7 UGS calculations, based on data from IHS Global Limited, March 2022

8 ICS, Shipping Industry Flag State Performance Table 2021/2022, January 2022