Greek shipping and economy 2016

The year 2015 was a very challenging one for the shipping markets, with lacklustre global commerce and slower than anticipated growth of the world economy. Global economic growth remained subdued at 3.1%, with emerging and developing countries recording a decline in growth for the fifth consecutive year and growth in advanced economies exhibiting a moderate and uneven recovery. The year was marked by: a slowdown and rebalancing of economic activity in China with less reliance on import - intensive investment and more emphasis on consumption and services, lower prices for energy and other commodities, a weak outlook for exports, and a dramatic decline in imports in some developing countries. A strengthening of the moderate recovery in the Eurozone, to positive growth in Japan and an entrenched recovery in the United States of America (US) have been tempered by overall low productivity growth, low investment worldwide, high public and private debt and financial sector weakness in some advanced economies.

The world’s slow recovery from the 2008 financial crisis has had a fundamental impact on the slowdown in global trade, which in 2015 exhibited a 2.6% growth1. Within the year, world seaborne trade ended with a 2% growth against a 3% world fleet growth. Overall, 2015 was a year of contrasting fortunes in shipping with rock bottom earnings in many sectors and a thriving oil tanker industry. The dry bulk market has been in steady decline with reduced trade activity and oversupply of vessels. The Baltic Dry Index has hit all-time lows and averaged 718 points in 2015, the second lowest annual average on record. Despite the fact that the dry bulk fleet growth eased to 2.4% in 2015 – the slowest pace in 16 years – lower Chinese demand for related imports (especially, iron ore and coal, minor bulk) and lower Indian coal imports put on increased pressures. In the container trades, 2015 was characterised by a clear upturn in earnings in the first half followed by a collapse of earnings in the second, with a 9% decline in freight rates level. Oil trade growth emerged as the largest driver of global trade growth primarily due to Chinese seaborne crude imports.

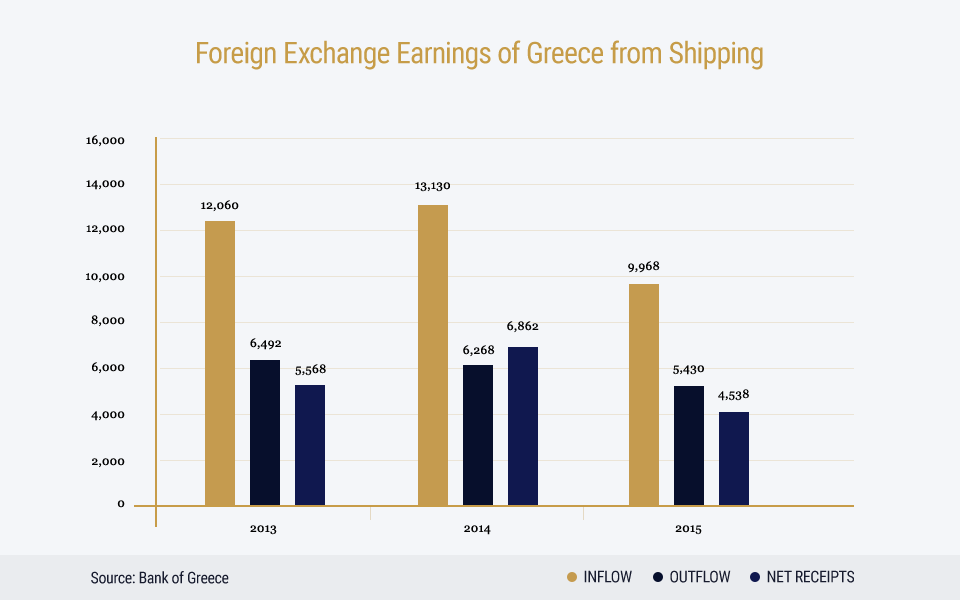

2015 was a year of turmoil both for the Greek economy and Greek shipping. Uncertainty regarding a new agreement between Greece, the European Commission, the European Central Bank and the International Monetary Fund and debates over Greece’s bailout programme, culminating in the July 2015 imposition of ‘capital controls’, have adversely affected the economy. The capital controls have had a sinking impact on the foreign exchange account balance and especially the foreign exchange earnings from shipping. The first half of 2015, receipts in the Services Balance of Payments2 that come from maritime transport services were €6.42 billion, an increase of 2.13%, compared to the same period in 2014, which was €6.29 billion. However, in the period July - December 2015 foreign currency inflow from maritime services reached only €3.54 billion, a decrease of almost 50% compared to the same period in 2014 which was €6.84 billion. This decrease is the joint result of capital controls and politico-economic instability. In total, the foreign currency inflow from shipping in 2015 was €9.97 billion, a decrease of 24% compared to the same period in 2014 which was €13.13 billion (Figure 1). Despite the dire economic situation, shipping remained one of the two stalwarts of the Greek economy. The receipts in the Services Balance of Payments from maritime transport services are estimated at approximately €142 billion for the years 2006-2015. Greek shipowners – following a voluntary agreement with the Greek state –started in 2014 to contribute an amount which will reach €420 million over a period of four years. This contribution aims at enhancing the fiscal revenues of the Greek state over this critical period for the Greek economy.

The Greek shipping is one of the last remaining truly entrepreneurial sectors comprising primarily small and medium-sized unquoted private companies, mostly family businesses. It is important that the special characteristics of this business model are understood and supported. The Greek shipping sector provides multifaceted benefits to Greece of a financial, social and strategic importance. According to reports by the Boston Consulting Group (BCG) and the Foundation for Economic and Industrial Research (IOBE) (2013), Greek shipping contributes over 7% of Gross Domestic Product (GDP), provides employment to 200,000 people and covers over 30% of the trade deficit. It is also significant that the Greek shipping industry was never part of the debt crisis of the Greek state. On the contrary, the consistent contribution of shipping to the Greek economy and the Balance of Payments over the past 35 years has been substantial and irreplaceable especially since the repatriation of Greek shipping companies which commenced in the 1980s.

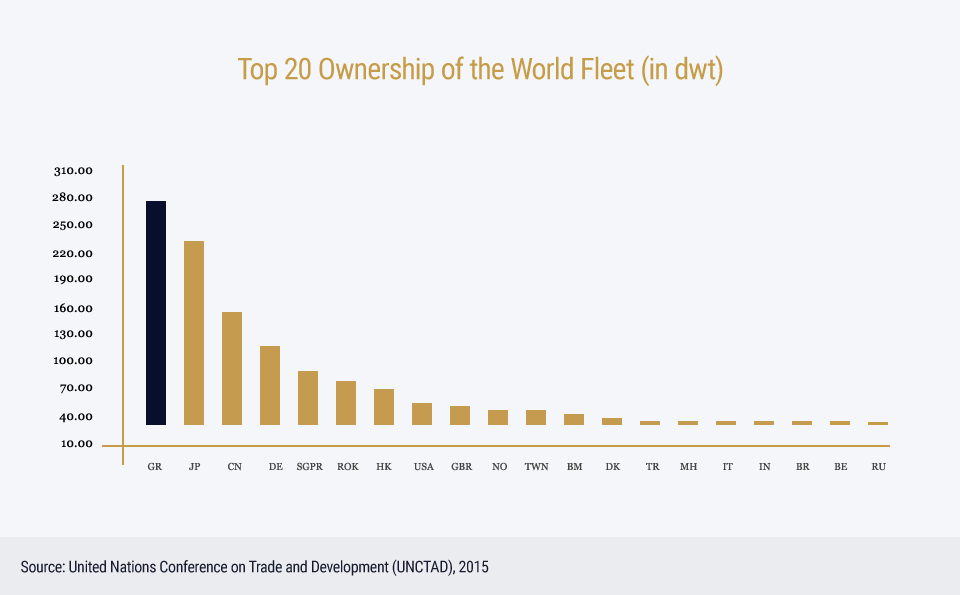

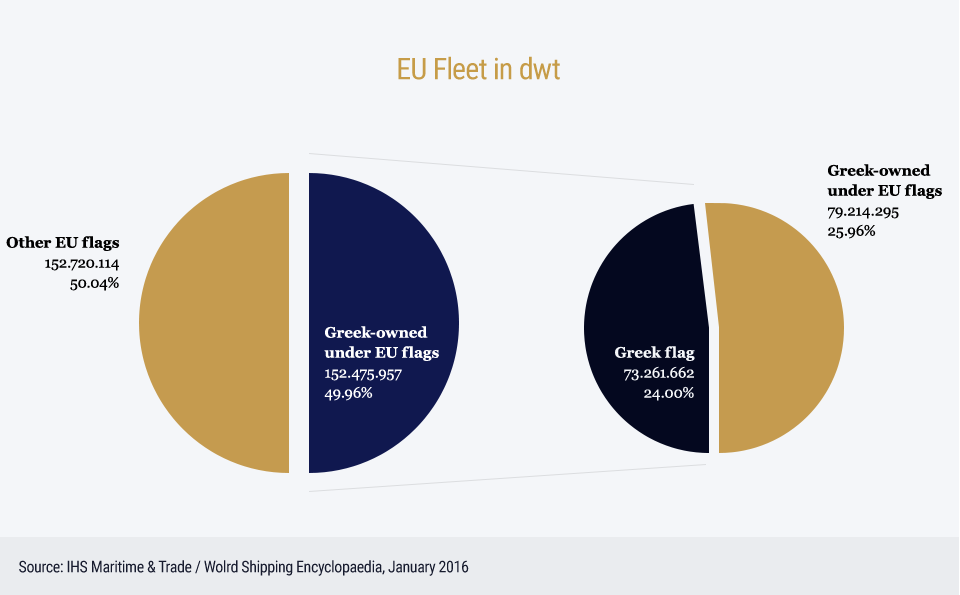

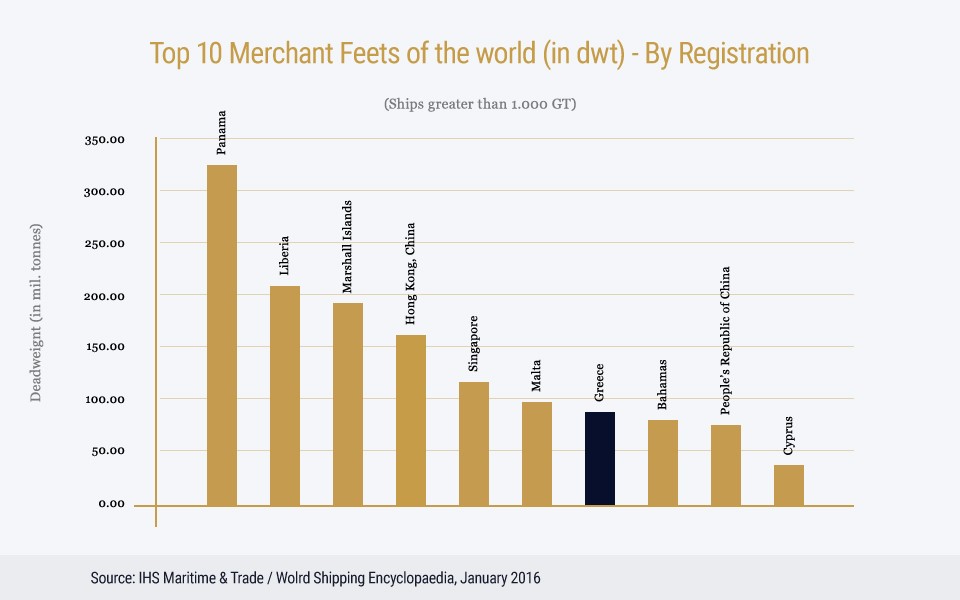

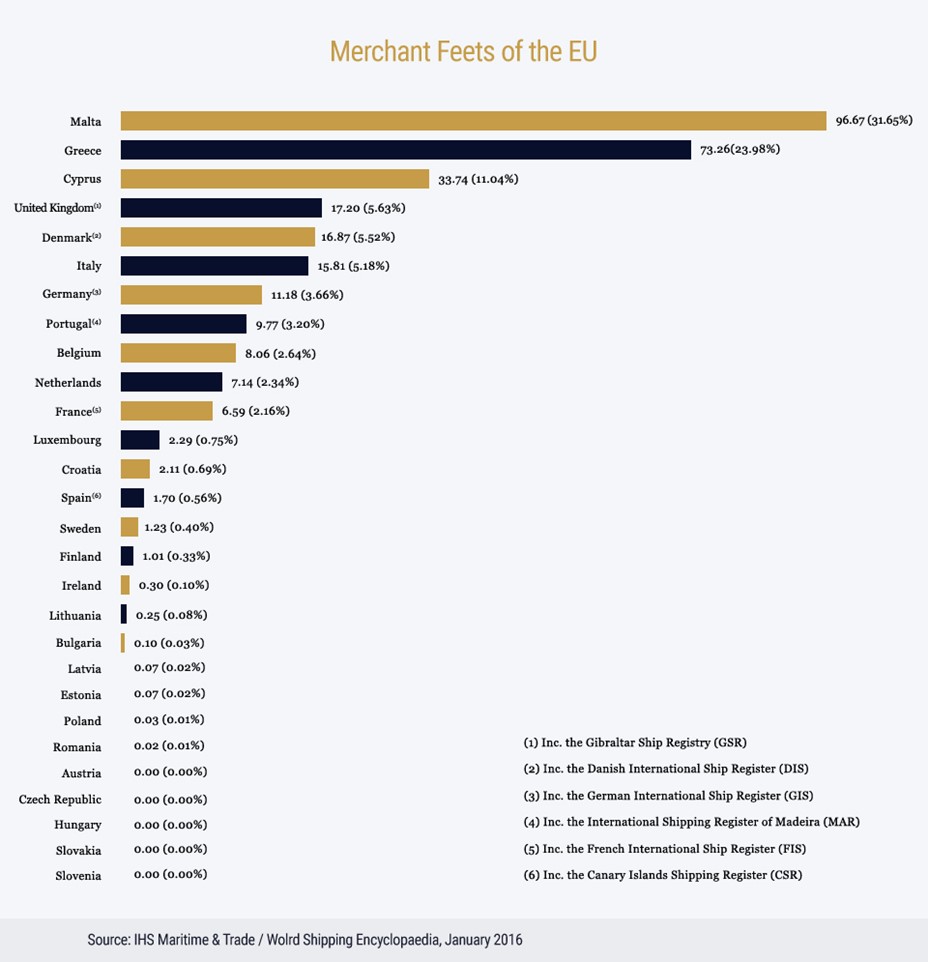

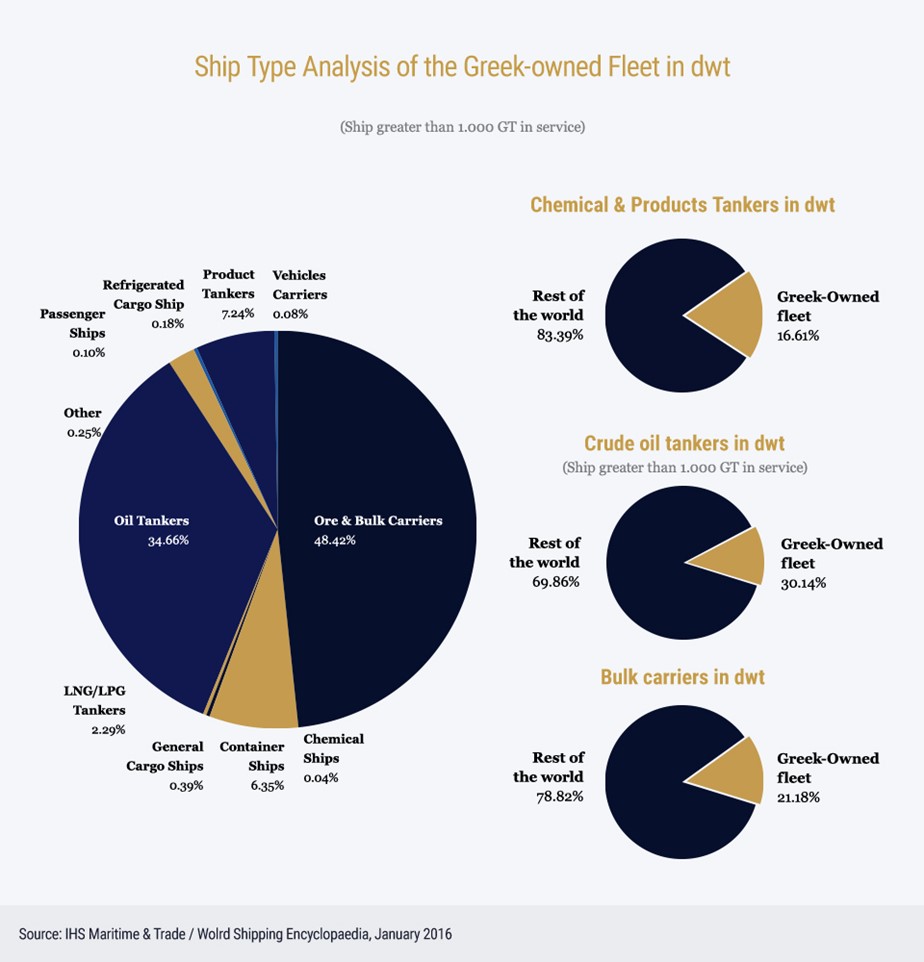

Despite the especially unfavourable economic environment in Greece and worldwide, Greek shipping has more than held its ground. Greek-owned tonnage holds the first position internationally (Figure 2). The fleet amounts to 4,585 vessels (ships over 1,000 gt) of 341.17 million deadweight tons (dwt) – an increase of approximately 22% from the previous year -, representing 19.63% of total world dwt and 49.96% of the total European Union (EU) fleet3 (Figure 3). Both figures indicate an increase compared to previous years. In 2015, the Greek Register accounted for 770 vessels (over 1,000 gt) amounting to 41.37 million gt4. The Greek flag fleet ranks seventh internationally (Figure 4) and second in the EU (in terms of dwt) (Figure 5). Moreover, Greek owners control 30.14 % of the world tanker fleet (crude oil tankers), 21.18% of the world bulk carrier fleet and 16.61% of the world chemical and products tanker fleet (Figure 6).

Against shrinking ship finance and a depressed freight market, newbuilding orders by Greek interests amounted to 407 vessels (over 1,000 gt), representing 44.83 million dwt in total of 3,507 orders of 260.35 million dwt5 placed for newbuildings by the end of 2015. Of these vessels, 221 were tankers corresponding to 25.88% of world tonnage (dwt) on order, including 63 LNG / LPG tankers amounting to 19.72% of world tonnage (dwt) on order, 153 bulk carriers corresponding to 14.39% of world tonnage (dwt) on order, 30 containerships corresponding to 6.12% of world tonnage (dwt) on order and 3 other vessels. Greek shipowners continue to renew their fleets by investing in modern, technically advanced, efficient and environmentally friendly ships gravitating towards larger ships on average. In 2015, they were also active in the sale and purchase market of second hand tonnage as they were involved in nearly 50% of all reported tanker and bulker deals either as buyers or sellers6. The prolonged period of extremely low freight rates, especially in the dry bulk sector, has resulted in a substantial increase of laid up ships.

Despite current challenges,Greek shipping aims to maintain its share of 50% of the EU and 20% of the world deadweight capacity.

The age profile of the Greek flag fleet in 2015 was 13.2 years and of the Greek-owned fleet 11.2 years, whilst the average age of the world fleet was 14.4 years7. The Greek fleet remains on the US Qualship 21 list, the International Maritime Organization (IMO) White List and the Paris Memorandum of Understanding (MOU) White List, while it is one of the safest fleets worldwide with less than 1% minor accidents recorded in 20158.

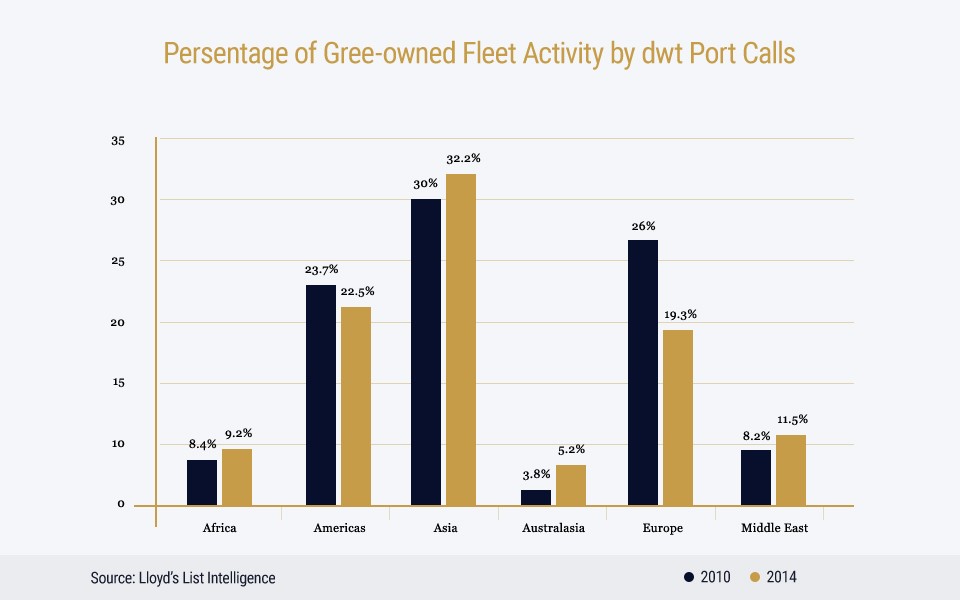

The Greek-owned fleet is the world’s largest cross-trading fleet with 98.5% of its trading capacity carrying cargoes between third countries, thus, rendering an indispensable service to the world. The Greek-owned fleet is highly responsive to shifts in trade patterns, such as the rise of Asian demand, while its importance for Europe is twofold: in relation to securing its import / export needs and boosting the EU maritime cluster. Shipping’s largest ‘shipowner’ zone in the world is the Athens / Piraeus cluster, closely linked to its national ownership base, contrary to other such owner zones, like Singapore and London, with an owner base attracted from around the world9.

2016 is expected to be exceptionally trying for world shipping. The shipping industry is expected to remain depressed with stagnating growth in large economies and the need for rigorous capacity discipline in order to manage the supply-demand imbalance. Geopolitical tensions, higher operating costs and cost of compliance with regulations, increased cost of lending and restricted access to finance add to the depressing picture. Additional challenges include the aftermath of the December 2015 Paris Conference agreement (COP 21) on climate change regarding CO2 emissions and the economic restructuring of China and of other developing nations’ economies as they become increasingly service-oriented.

Regarding the impact of the Greek shipping industry on the Greek economy see also below:

Information regarding the economic value of the EU shipping industry can be found in the “Oxford Economics study on the economic value of the EU shipping industry”, 2014, 2015, 2017, at ECSA site: www.ecsa.eu/policy-and-publications/other-publications

Information regarding the EU shipping competitiveness can be found in Monitor Deloitte’s “EU Shipping Competitiveness Study”, at ECSA site: www.ecsa.eu/policy-and-publications/other-publications