THE STRATEGIC IMPORTANCE OF GREEK SHIPPING FOR GREECE, THE EU AND THE WORLD

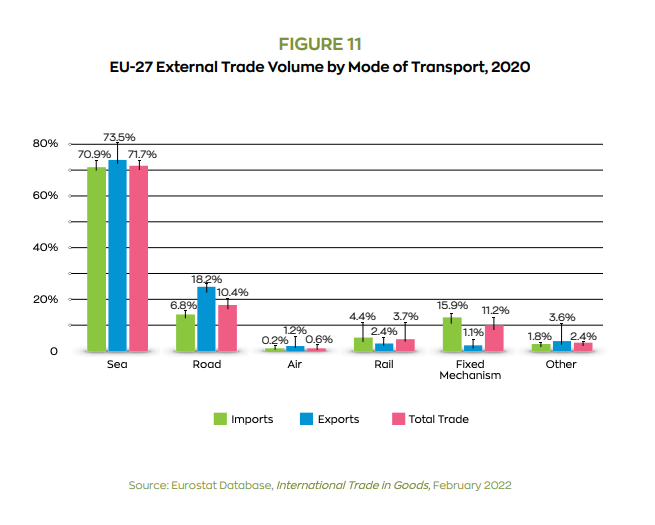

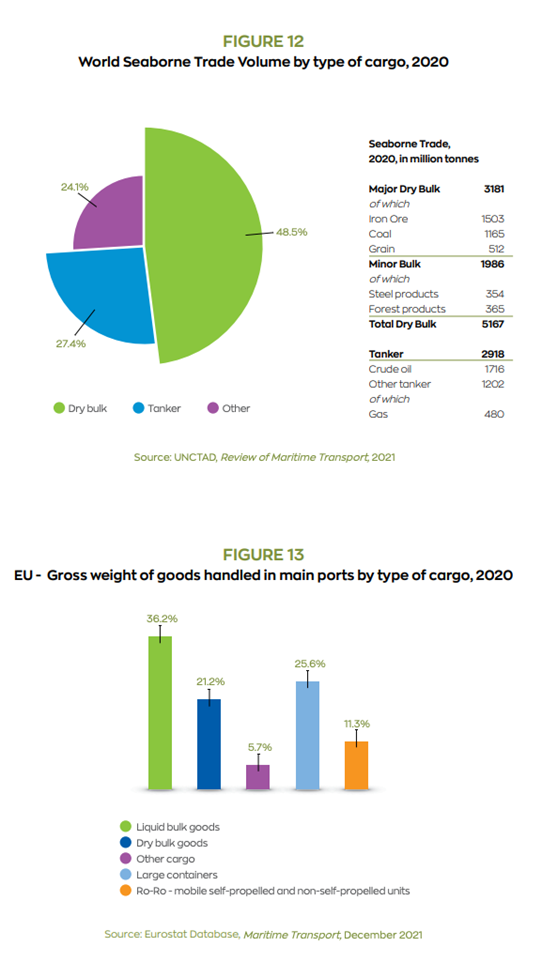

Almost 90% of the global merchandise trade is transported by sea. Seaborne trade accounts for almost 72% of the total volume of EU trade with the rest of the world (Figure 11). Dry bulk cargo and tanker trades account for more than 75% of the total volume of world seaborne trade (Figure 12) which amounted to 10,648 million tonnes in 2020. The bulk/tramp shipping sector represents also the largest part of the EU seaborne trade (Figure 13), highlighting its vital role for the EU economy and trade.

Shipping is crucial for the welfare of EU citizens as it ensures the supply of the vast majority of raw materials, energy, food and other staples. Seaborne trade accounts for the greatest part of the quantities imported and exported from EU Member States for the main categories of basic food products, energy and raw materials. In some cases, more than 85% of total trade volume is carried by sea, such as cereals (93%), animal and vegetable fats and oils (86%), non ferrous ores (93%), copper ore (97%)9. 90% of the total imports of Critical Raw Materials, which are essential to the EU economy due to their links with all industries and their importance for modern and clean technology products, are also transported by sea.

The maritime transport also plays an especially significant role in the intra-EU trade, as the EU relies on shipping for 33% of its internal trade10. The Short Sea Shipping (SSS) sector is pivotal in serving the EU trade while at the same time being one of the most environmentally friendly modes of transport. Enabling the decongestion of roads and with lower carbon footprint than other transport segments, the promotion of a sustainable and resilient Short Sea Shipping sector in Europe should remain a priority for the EU institutions.

Greek shipping is strategically important for the EU as:

• It is pivotal in securing the EU’s supply of energy and other essential commodities.

• It serves the EU’s import and export trade by being its main transport arm.

• With the EU’s energy security concerns on the rise, the Greek-owned fleet and in particular its coal carriers, oil tankers, product tankers and LNG/LPG carriers crucially secure and allow for diverse sources of energy and other essential goods imports into the EU from remote regions of the world, thereby facilitating its need to reduce its dependency on a limited number of countries.

• The EU imports 97% of its oil and petroleum products needs, 83.6% of its natural gas needs and 35.8% of its solid fossil fuels needs11. Out of these, 84% of crude oil, 76% of petroleum products and 39% of LNG/LPG imports are transported by sea12.

• The Greek-owned fleet is highly responsive to shifts in trade patterns and able to readily adapt to major reorientations of global trade flows and to ship designs with better efficiency, safety and environmental characteristics.

The strategic importance of Greek shipping for the EU is further highlighted in the context of the growing competition from Asian countries, whose aggregate shipowning is developing rapidly, gaining increasingly higher global market share.

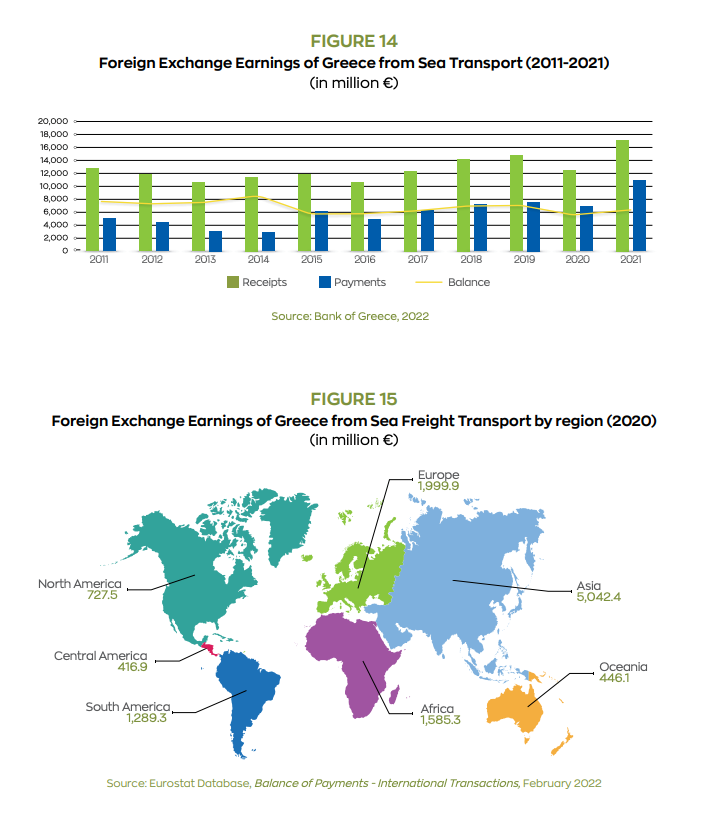

At a national level, Greek shipping is clearly a strategic asset and especially significant for the Greek economy. Maritime transport contributes more than 3% of the gross value added and accounts for almost 7% of the Gross Domestic Product (directly and indirectly), offering 200 thousand jobs13. It also provides sizeable net inflows to the Greek economy. In 2021, inflows to the Greek Balance of Payments by sea transport not only surpassed the 2019 levels, after the slump caused in 2020 by the outbreak of the COVID-19 pandemic, but are also the highest recorded after 2008, amounting to more than 17 billion euros (Figure 14). It is also noteworthy that Greek shipping provides these inflows to Greece from diverse regions of the world (Figure 15).

Greek shipping constitutes a major strategic sector for the Greek economy. It ensures the supply of food, raw materials and energy to Europe and worldwide.

9 Eurostat Database, International Trade in Goods, February 2022

10 European Commission, EU Transport in Figures, Statistical Pocketbook 2021

11 Eurostat Database, Energy Dependence, March 2022

12 Eurostat Database, International Trade in Goods, February 2022

13 Boston Consulting Group, 2013 & Deloitte, 2020